TRX Price Prediction: Analyzing the Path to $0.35-$0.40 by November 2025

#TRX

- TRX shows technical strength with MACD indicating bullish momentum despite current price being below moving average

- The $0.32 support level holding is critical for maintaining the bullish structure toward $0.35-$0.40 targets

- Broader market conditions and successful staking integration will be key determinants of TRX's price trajectory through November 2025

TRX Price Prediction

TRX Technical Analysis

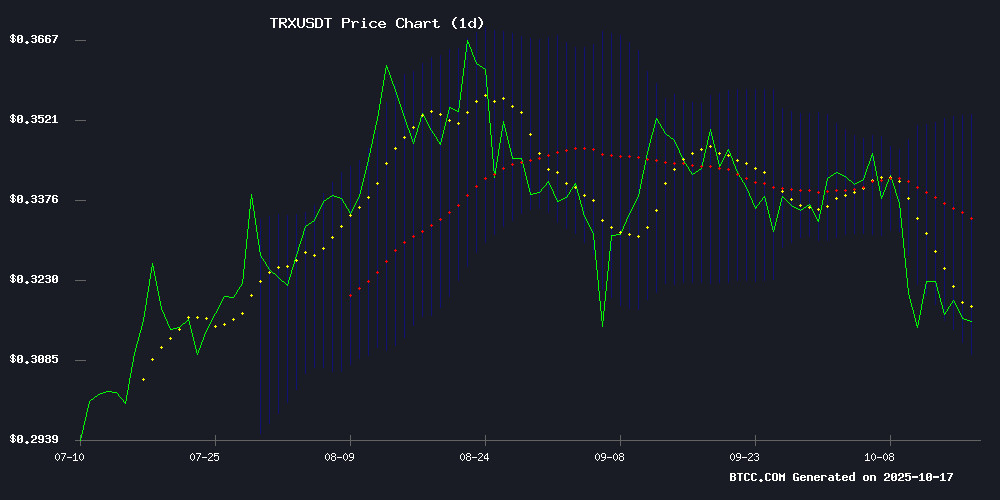

According to BTCC financial analyst William, TRX is currently trading at $0.3145, below its 20-day moving average of $0.3312, indicating short-term bearish pressure. The MACD shows a positive reading of 0.009398 above the signal line at 0.005255, suggesting potential bullish momentum building. The Bollinger Bands position the current price NEAR the lower band at $0.3092, which could act as support. William notes that a break above the middle band at $0.3312 could signal a trend reversal toward the upper band at $0.3531.

TRX Market Sentiment Analysis

BTCC financial analyst William observes that recent TRX developments show mixed sentiment. The integration of TRX staking on Ledger Live via Yield.xyz provides positive utility, while Bitcoin's significant correction below $110,000 has created broader market uncertainty. William emphasizes that TRX's ability to hold the $0.32 support level remains crucial, with technical analysis suggesting the $0.35-$0.40 target range by November 2025 remains achievable if broader market conditions stabilize.

Factors Influencing TRX's Price

TRX Price Prediction: TRON Targets $0.35-$0.40 by November 2025 Despite Bearish Momentum

TRON (TRX) exhibits mixed signals as analysts project a potential climb to $0.35-$0.40 by late 2025, contingent on breaking key resistance levels. Current technical analysis highlights $0.30 as strong support, with the upper Bollinger Band suggesting a bullish breakout at $0.35.

Market sentiment remains cautiously optimistic. Changelly's short-term forecasts hover between $0.314 and $0.321, reflecting consolidation patterns. In contrast, PricePredictions.com's ambitious $1.03 target—a 222% surge—stands at odds with CoinCodex's conservative $0.343686 near-term estimate.

The divergence in projections underscores TRON's volatile positioning. While gradual recovery appears probable, the magnitude of gains remains contested among analysts.

TRX Staking Now Available on Ledger Live via Yield.xyz Integration

Yield.xyz has integrated TRON's TRX staking into Ledger Live, offering millions of users seamless access to governance rewards while maintaining hardware wallet security. The collaboration simplifies TRON's Delegated Proof of Stake (DPoS) mechanics, abstracting validator elections and reward cycles.

Super Representatives like Google Cloud, Binance, and Kraken underscore institutional confidence in TRON's infrastructure. This move signals growing mainstream adoption of blockchain governance mechanisms through trusted financial interfaces.

Bitcoin’s Dip Below $110,000 Triggers $524M Crypto Liquidation Wave

Bitcoin's sudden plunge below $110,000 sparked a cascade of liquidations across cryptocurrency markets, with leveraged positions worth $524 million wiped out in Thursday's sell-off. The leading digital asset briefly touched $109,800 before recovering to $110,418, down 1.3% on the day.

Ethereum mirrored the downturn, falling 1.8% to hover near $4,000. Major altcoins suffered steeper losses—XRP dropped 4% to $2.40, while Solana and Cardano slid 4.9% and 3.5% respectively. Only Tron defied the trend with a 1.2% gain.

Options markets flashed warning signs as traders piled into bearish bets, anticipating further downside. The total crypto market cap contracted 3.1% to $3.85 trillion, with SynFutures COO Wenny Cai noting 'risk-off sentiment driving liquidity rotations into Bitcoin and stablecoins.'

Tron TRX Price Holds $0.32 Support, Bulls Target $0.35 Next

Tron's TRX price has rebounded 1.12% to $0.322, defying a weekly decline of 5.07% and monthly drop of 6.93%. Oversold RSI conditions and bullish futures CVD data suggest a technical recovery. The SRM merger, granting Tron a Nasdaq listing, has injected institutional confidence.

As the dominant stablecoin settlement chain, Tron hosts over $80 billion USDT and processed $15.6 trillion in transfers last quarter. Liquidity remains strong at the $0.31-$0.32 support zone, with RSI now at 39.16—exiting oversold territory.

How High Will TRX Price Go?

Based on current technical indicators and market developments, BTCC financial analyst William projects TRX could reach the $0.35-$0.40 range by November 2025. The technical setup shows TRX trading at $0.3145 with key support at $0.32 holding strong. The MACD indicates building bullish momentum, while the Bollinger Bands suggest potential upside to $0.3531 in the near term.

| Indicator | Current Value | Significance |

|---|---|---|

| Current Price | $0.3145 | Below 20-day MA, testing support |

| 20-day MA | $0.3312 | Key resistance level |

| MACD | 0.009398 | Positive, indicating bullish momentum |

| Bollinger Upper | $0.3531 | Near-term target |

| Support Level | $0.3092-$0.3200 | Critical for maintaining bullish structure |

William emphasizes that successful staking integration and Bitcoin market recovery are crucial catalysts for achieving the projected price targets.